Are you curious to know what is DD number? You have come to the right place as I am going to tell you everything about DD number in a very simple explanation. Without further discussion let’s begin to know what is DD number?

The term “DD Number” often arises in financial transactions and official documentation, leaving many curious about its meaning and importance. DD stands for Demand Draft, a widely used payment instrument in banking and financial sectors. In this blog post, we will unravel the mystery behind the DD Number, exploring its purpose, significance, and how it plays a crucial role in various financial transactions. Join us as we delve into the world of DD Numbers and gain a deeper understanding of this essential component of financial transactions.

What Is DD Number?

The DD Number is a unique identification number assigned to a Demand Draft issued by a bank or financial institution. A Demand Draft is a payment instrument that allows individuals to make secure and convenient payments, similar to a check, but issued by a bank instead of an individual.

The Significance Of The DD Number:

- Tracking And Verification: The DD Number serves as a reference point for tracking and verifying the details of a specific Demand Draft. It acts as a unique identifier, allowing banks and individuals involved in the transaction to retrieve information related to the payment.

- Proof Of Payment: The DD Number serves as evidence of payment made through a Demand Draft. It can be used to validate the completion of a financial transaction and serves as a reference in case of any discrepancies or disputes that may arise.

Obtaining The DD Number:

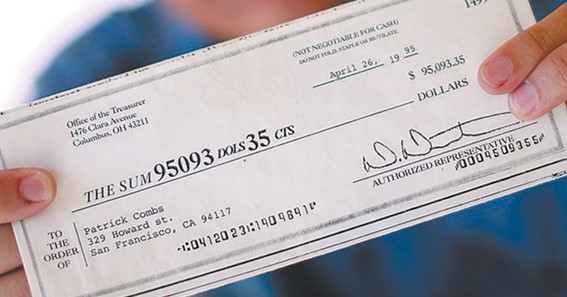

When a person requests a Demand Draft from a bank, the bank assigns a specific DD Number to that draft. The DD Number is typically mentioned on the Demand Draft itself, along with other relevant information such as the issuing bank’s name, the payee’s name, and the amount of the draft.

Utilizing The DD Number:

- Tracking Payment Status: With the DD Number in hand, individuals can track the status of their payment. They can inquire with the bank about the progress of the Demand Draft, including whether it has been encashed or not.

- Reference In Documentation: The DD Number is often required in various official documentation, such as application forms, invoices, or receipts. It serves as a vital piece of information to link the payment to a specific Demand Draft.

- Resolving Disputes: In case of any discrepancies or issues related to the payment made through a Demand Draft, the DD Number becomes crucial for resolving disputes. It allows banks and individuals to trace and investigate the transaction, ensuring a fair and transparent resolution.

Precautions And Security Measures:

- Safeguarding The DD Number: It is essential to protect the confidentiality of the DD Number, as it serves as a key identifier for a payment. Individuals should avoid sharing the DD Number with unauthorized individuals or entities to prevent misuse or fraudulent activities.

- Validity And Expiry: Demand Drafts typically have a validity period during which they can be encashed. It is important to be aware of the expiry date mentioned on the Demand Draft to ensure timely encashment.

Conclusion:

The DD Number is a significant component of financial transactions involving Demand Drafts. It serves as a unique identifier, allowing individuals and banks to track, verify, and reference payments made through Demand Drafts. Understanding the significance of the DD Number empowers individuals to navigate financial transactions confidently and efficiently. So, the next time you encounter a DD Number, you can appreciate its importance and recognize its role in facilitating secure and convenient payments.

Let’s find some more interesting topics like these here askcorran

FAQ

What Is The DD Number?

What is Demand Draft Number? The DD number is a 6-digit numeric code, or a serial number found at the bottom of the instrument and next to it is the Magnetic Ink Character Recognition (MICR) code. The DD number is just like a cheque number, a unique code is used to complete each transaction.

Where Is The DD Number In Demand Draft?

The DD number is right there in your demand draft, at the bottom of the check. At the bottom left hand side you will see a long number, however you don’t need to enter the entire number when asked for the DD number. This is only a small part of that big number. So, in this case the DD number will be 876439.

What Is DD In Bank Used For?

Demand draft or DD is a method used by an individual or a bank to transfer money from one bank account to another. Demand drafts differ a lot from cheques, as they do not require the signature of the account holder to be cashed.

What Is DD In Debit Card?

Demand Draft also called DD is a way to initiate transactions from one bank to another. It is a negotiable instrument that guarantees payment of a specific amount of money to the specified payee. Demand draft is only issued by the bank and one cannot issue a DD on an individual level.10-Jan-2023

Is DD An Identification Number?

DD is an abbreviation for Document Discriminator. A number of states started adding this piece of information to their driver’s licenses several years ago. The DD is a security code that identifies where and when the license was issued. It, thus, uniquely identifies each card for a given individual.

I Have Covered All The Following Queries And Topics In The Above Article

What Is DD Number In Demand Draft

What Is The Channel Number Of DD Sports In Tata Sky

What Is DD Number On Demand Draft

What Is The DD Number

What Is DD Number In Demand Draft Of Sbi

What Is The Channel Number Of DD National In Tata Sky

What Is DD Number Sbi

What Is DD Number In Banking

What Is DD Number Hdfc

What Is DD Number Example

What Is DD Number In Sbi

What Is DD Number

What is a DD number?