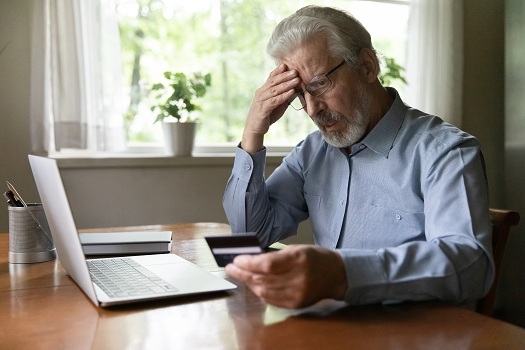

It is a well-known fact that older adults often struggle with credit card debt and payday loans, particularly the latter. Lenders are fully aware that seniors rely on social security payments and retirement funds, making them vulnerable targets for loans.

Although it may be advantageous for lenders to issue loans, it is not always a simple matter for seniors. Often, they do not have sufficient breathing space when it comes to their finances.

In case they find themselves in a financial bind, there are programs available that can assist them in consolidating and settling their debts. Here are four methods of helping seniors consolidate and settle their debts:

-

Payday Loan Debt Consolidation

Payday loans may be simple to acquire, and a good credit score is not a requirement. However, the short repayment period of just two weeks and high-interest rates are significant disadvantages. Payday loans are often compared to debt traps that ensnare and exploit the most vulnerable.

The most viable solution is to enroll in a payday loan consolidation program and devise a plan to pay off cash advance loans systematically.

-

Balance Transfer Credit Card

A balance transfer credit card consolidates all of your debt into a single account, simplifying things with just one fixed bill payment every month. Utilize this card to pay off any pending loans and credit cards.

-

Debt Settlement

Debt settlement is also an excellent option for reducing the weight of the debt. Debt negotiators will negotiate with creditors to agree on a feasible amount that your older adult can afford to pay. After the payment is made, they will be debt-free. Find out more in this article: What is the HM debt management office?

-

Reverse Mortgage

A reverse mortgage resembles a home equity loan, with the only difference being that there are no monthly payments. The loan payments become due upon the death of the last living borrower. The living relatives must either pay the mortgage or sell it to balance out the loan payments.

To qualify for a reverse mortgage, you must be 62 years old, have a significant amount of equity in the house, and be capable of paying for expenses such as property taxes and insurance on a monthly basis.

Consolidating and settling debts can be a daunting task for seniors. Fortunately, several programs are available to assist them in this endeavor. It is crucial to weigh all of the options and choose the best one based on the circumstances to avoid further financial difficulties.