Since the concept of EMI (Equated Monthly Installment) came into existence, the purchasing power of individuals has increased. However, purchasing durable and lifestyle products has never been so easy. For a person unwilling to spend much, going ‘All in’ with all the hard-earned savings is never a wise call.

Everything is pricey nowadays, from a top-notch television to the latest

gaming console. However, once a potential borrower plans for an EMI card apply online, and they open many doors for themselves.

What is an EMI?

EMI is a fixed amount of money a borrower agrees to pay to a lender each month while repaying a particular loan amount. Notably, the total amount paid over the loan’s tenure is divided into equal payments. Moreover, this EMI includes the principal and interest amounts on loans.

What is an EMI card?

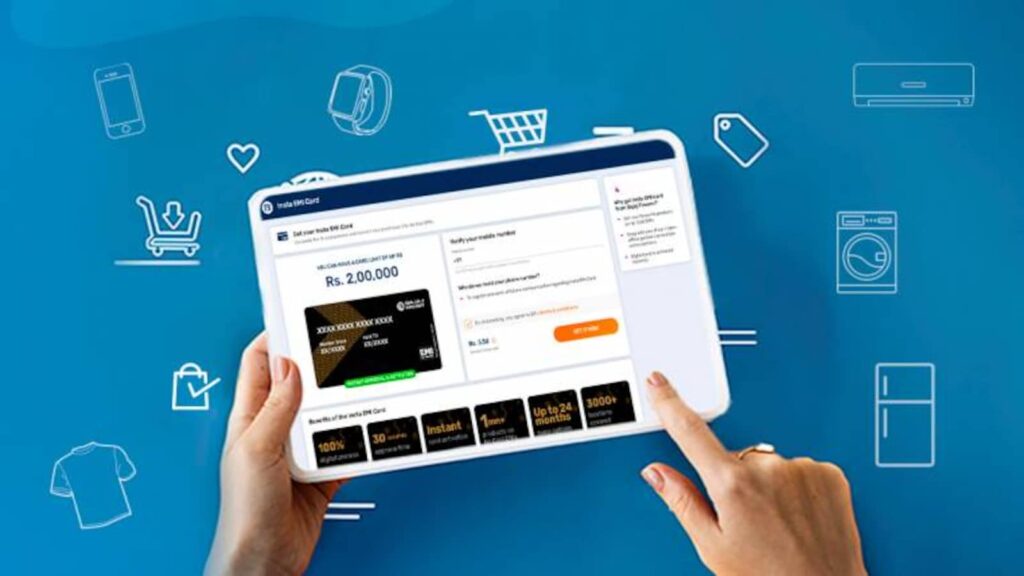

It is a payment card that allows customers to purchase services or goods on credit and pay for them later in installments over a fixed tenure. These are usually issued by very few companies in India, and they work just like credit cards.

So, basically, when a customer makes a purchase using an EMI card in India, the cost is divided into equal installments. Further, the customer is then required to pay back the purchase cost, along with any interest charges, over the agreed-upon period. These cards often finance larger purchases like home appliances, electronics, or other high-value items.

This is quite a convenient way to make purchases, especially for those who may not have the funds to pay for a significant purchase immediately. However, they need to be well aware of the rate of interest and fees associated with EMI cards.

I’d like to share my personal experience of using an EMI card, the one offered by Bajaj Finserv.

What are the Features of a Bajaj Finserv EMI Card?

-

Pre-approved loan

This card comes with a loan amount (pre-approved) of Rs 2 lakh, which is quite a huge amount.

-

Minimal and basic documentation

The potential borrower must submit documents on their first purchase at any of its partner stores to apply for the EMI card. I still remember how I got lucky while purchasing my refrigerator as I landed up applying for this card. Another easy method is EMI card apply online by going on their official website and applying.

-

Flexible Repayment Tenure

Repayment for the amount spent by this card can be made within a flexible tenure. This period varies from 3 months to two years.

-

E-wallet

After purchasing this card, one can use it without carrying it via the Bajaj Finserv Wallet App. So there is no need to take it in your wallet everywhere.

What is the eligibility to get this card?

- Age should not be less than 21 years and not more than 60 years

- Should have a regular source of income

How to get an EMI card in India?

- Download the Bajaj Finserv app

- Once you log in, you’ll see the option for EMI Network Card under the ‘Products for you’ section on the homepage.

- Tap on it and tap on Get it now.

- Enter all the required details and proceed further.